Liquidity Locks: A Proven Way to Build Community Trust

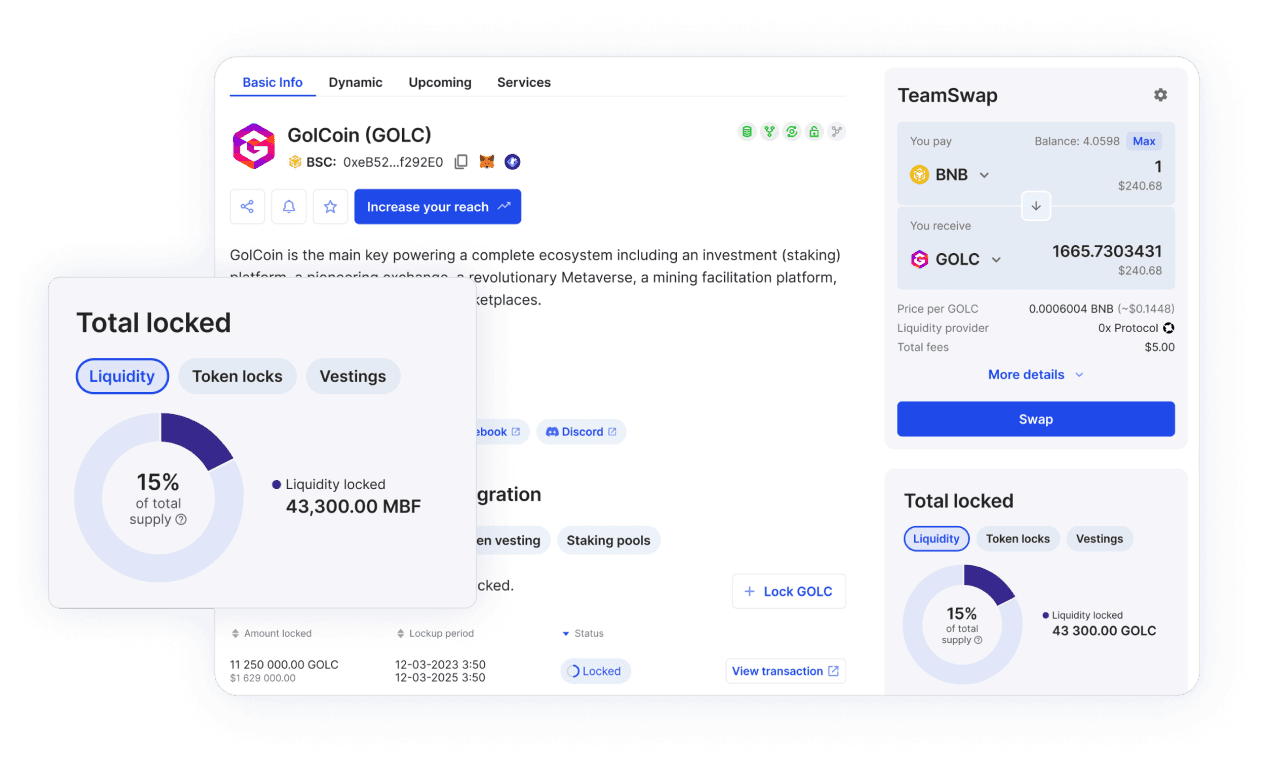

In crypto, trust is everything. Projects that lock their liquidity instantly boost credibility, reduce risk, and attract more buyers. By using Team Finance, projects can lock their liquidity in under two minutes—protecting holders, preventing rug pulls, and signaling long-term commitment.

When it comes to buying a new token, the first question every token holder asks is simple: “Can I trust this project?”

In the crypto space, trust will make or break your project, if the trust is not there your token will not be traded. One of the easiest ways to signal that your project is serious, is to lock the liquidity, it takes just 2 minutes on Team Finance and data shows that projects who lock liquidity see more people buying their token.

What is a liquidity lock?

Liquidity lock is exactly what it sounds like - a project takes the liquidity they’ve provided for their token (their token usually paired with the chains native token or USDC/USDT), and locks it in a liquidity lock smart contract for a set period. During this time, those liquidity tokens can’t be withdrawn.

For token holders, that’s huge. It’s a guarantee that the team can’t just withdraw the liquidity from the pool, and run off with the funds. Liquidity locks are simple, but effective.

Why do communities care?

Community members in crypto are hyper-aware of risk, navigating the space you need to be super careful, rugs and scams are everywhere. For this reason, tokens without locked liquidity are often avoided, even if the project has a solid roadmap, it’s hard to trust a project that could steal your funds at any moment. When the project locks liquidity, they’re basically saying ‘we’re committed for the longer term’.

It’s not just about preventing rug pulls - it’s basic psychology. When people see locked liquidity, they feel safer entering the market. That confidence translates directly into more buyers and increased trading activity.

How locked liquidity drives trading behavior

When a token’s liquidity is locked, token holders and potential new community members don’t have to fear getting rugged. Ever been on pump.fun? There’s no liquidity lock, and that's why more than 99% of tokens are rugged by the creators.

A project that locks does not need to be trusted, they’ve made a visible statement and removed the ability to rug you. The community is happy and they feel safe to trade, which drives a higher trading volume and less volatility in the token price.

Imagine two projects launching tomorrow: Token A has unlocked liquidity, Token B has a locked pool for 12 months. Which one do you think will attract more token holders on day one? Token B. Everyone likes to know their token isn’t at risk of being rugged at any moment.

Locked liquidity also encourages holding. When crypto community members see that liquidity can’t be drained, they’re more likely to hold and stake those tokens, rather than get in and out quick for a small profit, or panic-sell at the first sign of price movement. Token holders that feel safe to hold, creates the stability a healthy token economy needs.

Benefits for Projects

Locking liquidity isn’t just for community members, it’s a win for the project too. Locked liquidity:

- Boosts credibility instantly.

- Shows on DexTrackers the liquidity is locked and safe to trade.

- Signals to the community that the team is serious.

- Can be used as a marketing tool, creating announcements on Crypto Twitter to attract more attention and trust from the community.

The Bottom Line

Locked liquidity isn’t just a security measure - it’s a growth hack. It builds confidence, stabilises trading, and signals to the community and market that your project is in it for the long term. The more transparent you are, the easier it is to attract and retain token holders.

If you haven’t locked your liquidity yet, now’s the time. Protect your community, grow your community, and show the market you mean business - it takes just 2 minutes on Team Finance.

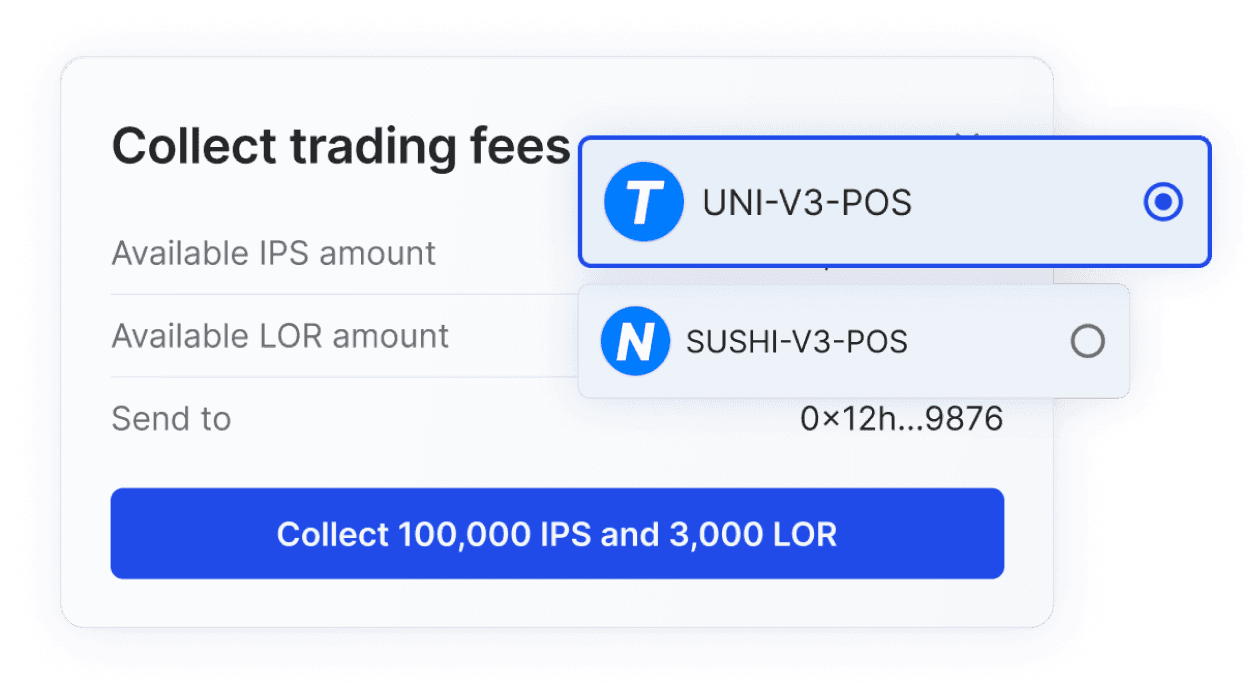

Team Finance enables you to lock liquidity across 20+ blockchains, including support for V2 and V3 LP tokens, with V4 support coming soon.