How to Find the Best Liquidity Locker

The ultimate guide on how to select a liquidity locker for your project...

You know what they are, why you need one (stopping rug pulls for example), but you don't know how to find the top liquidity locker for your project.

What options do you need to consider?

Should you care more about wallet integrations, team transparency, or pricing?

Where do you lock your tokens or liquidity pools?

As one of the longest running and top providers, let's guide you through choosing the best liquidity locker service...

1. Security and Trustworthiness

The security of your liquidity is not negotiable.

When choosing a liquidity locker, look for a platform with a proven security processes and audits.

The strength of the smart contracts used by the provider plays an important role in preventing unauthorized access, vulnerabilities and potential exploits. Always choose a locker that prioritizes your security to protect your assets and community for your project.

What to look for:

- Track Record:

- Have the smart contracts been audited by multiple companies like Certik, Hacken and Bailsec?

- Is there a history of successful audits?

- What’s the locker’s community reputation?

- Is the smart contract audit publicly accessible?

At TrustSwap, security and trust are the core of our operations and partnerships. We believe that true innovation in the web3 happens when trust is built via transparency.Our token locks feature exemplifies our dedication to creating a trustworthy environment where Web3 innovators can engage with our community in a openly, thus increasing engagement.By adhering to the latest standards and conducting regular smart contract audits, we turn security from a conceptual promise into a practiced discipline. - Naïm Boughazi, TrustSwap CEO

2. Transparency

The best liquidity lockers offer clear, easy to understand documentation that details every aspect of the locking process. Literally a step by step guide.

Including everything from the fees for the tool to the exact terms of the lock.

Additionally, the ability to publicly verify locked liquidity on the blockchain is a must - can you see other tokens liquidity percentages on their platform?

This feature allows anyone to confirm that the liquidity is really locked, providing an extra layer of trust and security.

Key Points:

- Documentation Should Include:

- Clear instructions on the locking process.

- Detailed terms and conditions.

- Pricing breakdowns and potential hidden costs.

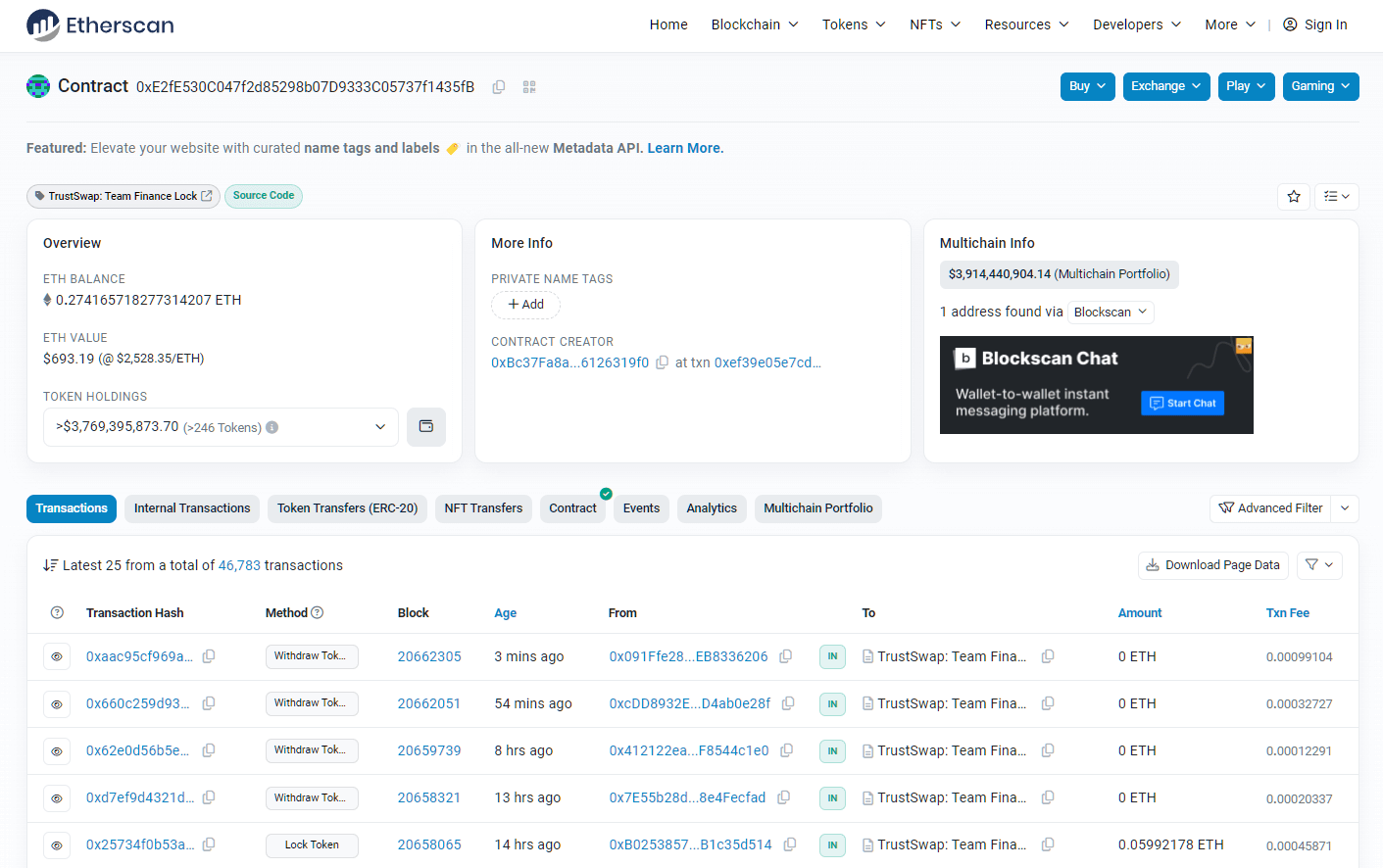

- Can you find the smart contract address for the provider?

- Public Verification:

- Can the locked liquidity be independently verified on the blockchain?

- Can you view other projects on their platform, searching for addresses and project names easily?

3. Flexibility and Advanced Features

Find a locker that offers flexibility with features like splitting, incremental locks, or transferring ownership.

Continually evolving and adding new features shows a service provider that is in it for the long term. A service that listens to the community, takes feedback, and stays on the cutting edge of innovation is a good sign.

Key Points:

- Customization and Flexibility:

- Look for a locker that allows you to tailor liquidity management for your needs.

- Multiple packages, options, or some degree of customisation would be preferential.

- Continuous Improvement:

- Choose a provider that regularly updates its platform, adding new features and improvements based on user feedback.

- Security and Adaptability:

- Seek out a service that can securely adapt to changes in project ownership or management without compromising liquidity.

- Ensure the locker is capable of scaling and evolving as web3 grows and changes over time.

4. Multi-Chain Support for Versatility

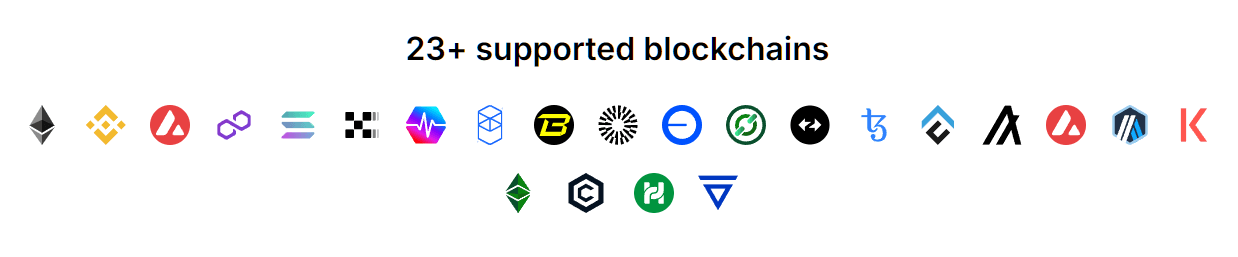

As the DeFi landscape grows, so does the need for cross-chain compatibility.

A good liquidity locker should work with multiple blockchains like Ethereum, Binance Smart Chain, and Polygon. This makes sure your project can run smoothly on different platforms, no matter where your token is traded.

Supporting multiple blockchains is a sign of an good, innovative, and continually growing liquidity lockr.

Having multi-chain support allows your project to operate seamlessly across different chains.

Keeping up to date with not just Ethereum, BSC, or Polygon, but also chains like Etherlink, X Layer, and Base means the lock provider is capable of growing with you.

What to look for:

- Supported Blockchains:

- How many blockchains do they support - 5? 10? 20+?

- Interoperability Considerations:

- Can the locker integrate seamlessly with different DEXs?

- How easily can you manage liquidity across multiple chains?

5. User Experience Matters

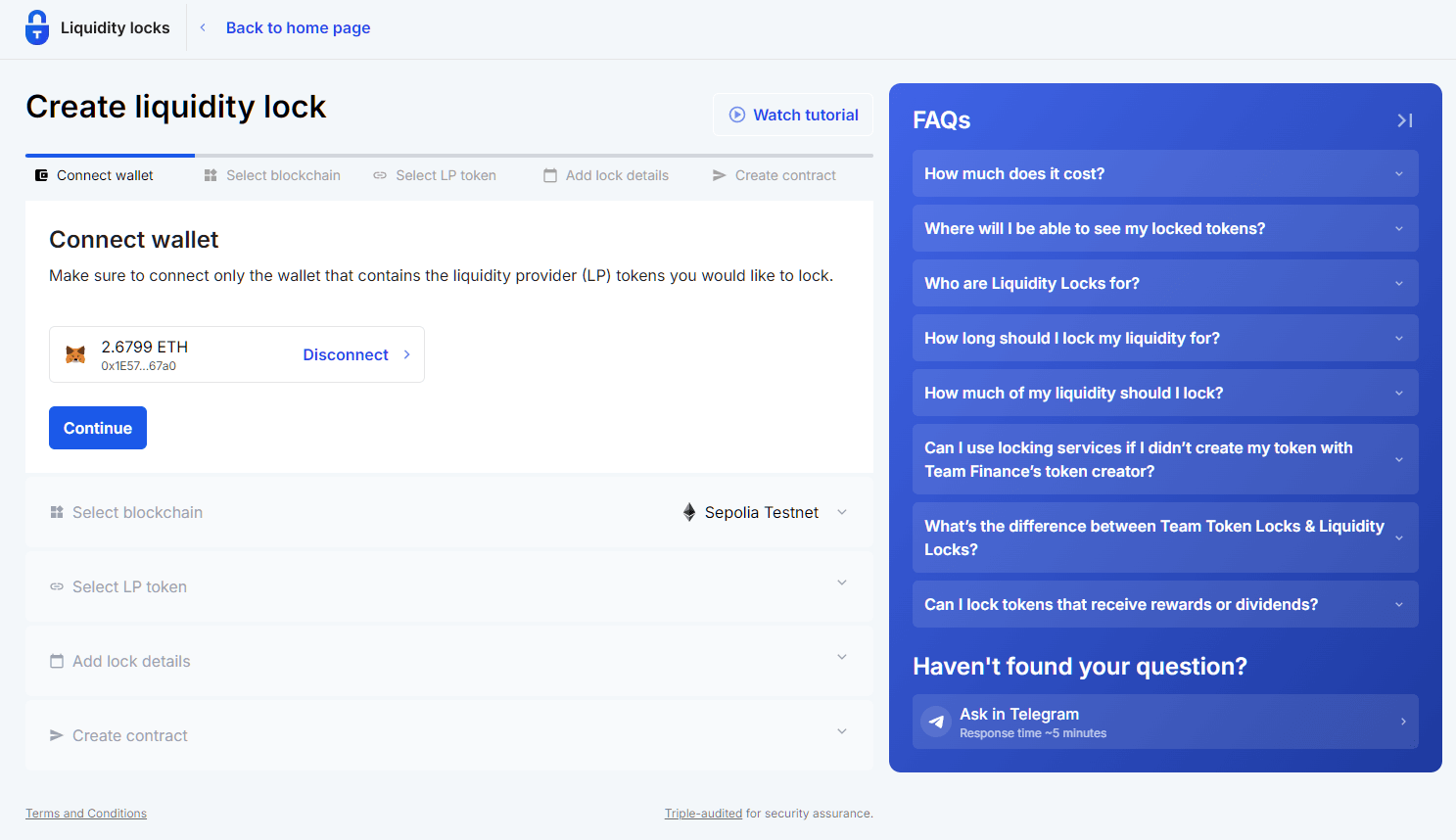

A friendly UI can make all the difference, especially if you're looking for no-code services.

The best liquidity lockers have intuitive dashboards, clear step-by-step guides or tutorials, making the process of locking and unlocking easy.

Being able to easily set locking periods, unlock dates, and lock LP tokens, sounds like a simple ask - but not all do it well.

Key Points:

- User Interface (UI/UX):

- Is the wizard easy to use?

- Does it provide clear guidance for each step?

- Are there YouTube tutorials, guides, and FAQs?

- Customer Support:

- Availability of live chat, email, and easy to find contact pages.

- Responsiveness to user queries.

6. Reputation and Reliability

A strong reputation in the community is often a good indicator of reliability. Additionally, consider the adoption rate of the locker - widespread use within the industry can be a sign of trust and stability.

How long have they been established?

Are they being used on a regular, and consistent basis?

Do they display testimonials, case studies, or a way for you to view other coins and tokens that used the tool?

7. Understanding Costs and Fees

Are the fees easily found, understood, and display all costs for the liquidity locking service?

Compare these costs with the features and security offered to ensure you’re getting value for money. A transparent, reasonable fee structure is key to avoiding unpleasant surprises down the line.

Key Points:

- Potential Fees to Consider:

- Locking fees

- Unlocking fees

- Maintenance fees

- Fixed vs flexible pricing

- Does the provider offer pro / enterprise services?

- Hidden Costs:

- Early unlock penalties

- Additional charges for extended lock durations

We know that gas fees could be included here, but that's fairly market flexible. But it's still important to consider when using the services.

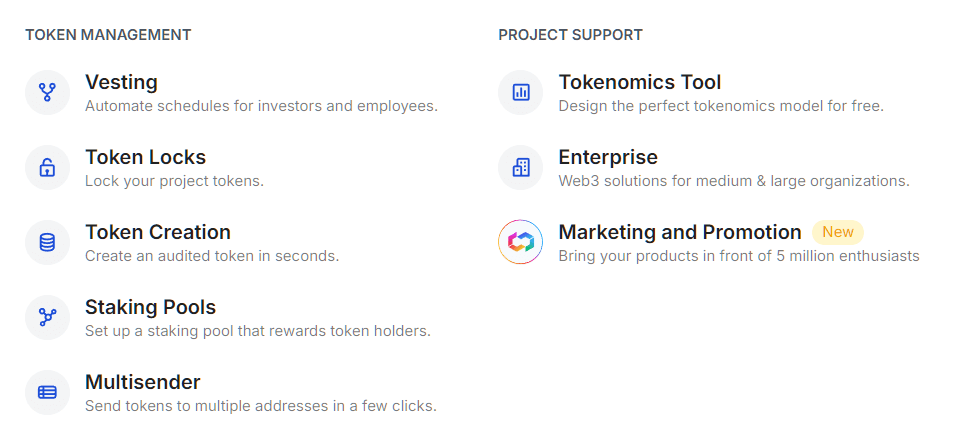

8. Additional Token Services

Does the liquidity locker have other DeFi and token management services?

Consider the full liquidity management of your project - do you need other tools?

When choosing a locker, look for platforms that include other services like token vesting, launchpads, and multisender.

Many providers only have a single landing page, one style of service, or only work with a handful of blockchains.

Consider a token management solution that expands into other necessary services and chains - showing full ecosystem support for serious projects.

9. Regulatory Compliance and Legal Considerations

Regulatory compliance is becoming increasingly important, but it's also difficult to understand.

Make sure that the liquidity locker you choose operates within the legal frameworks. This might include adhering to local and international regulations or providing regular audits and compliance reports.

Choosing a compliant locker can help protect your project from legal risks and build investor confidence.

On top of this, consider standard website privacy policies, terms and conditions, and proper cookie management for users.

10. Scalability and Future-Proofing

Your project is should grow, it should be supported and given the tools needed to help it thrive, and your liquidity locker needs to scale with it.

Evaluate the locker’s ability to handle increasing volumes and whether it has the infrastructure to support high transaction loads.

Quite literally - is it safe under heavy use, and able to avoid downtime?

Additionally, consider the locker’s adaptability to market changes.

Has it remained stable and continued to grow in bear market conditions?

What to look for:

- Scalability Considerations:

- How well can the locker handle increasing volumes?

- Is the locker infrastructure capable of managing high transaction loads?

- Future-Proofing:

- Can the locker adapt to new blockchain technologies?

- How does the locker plan to evolve with market changes?

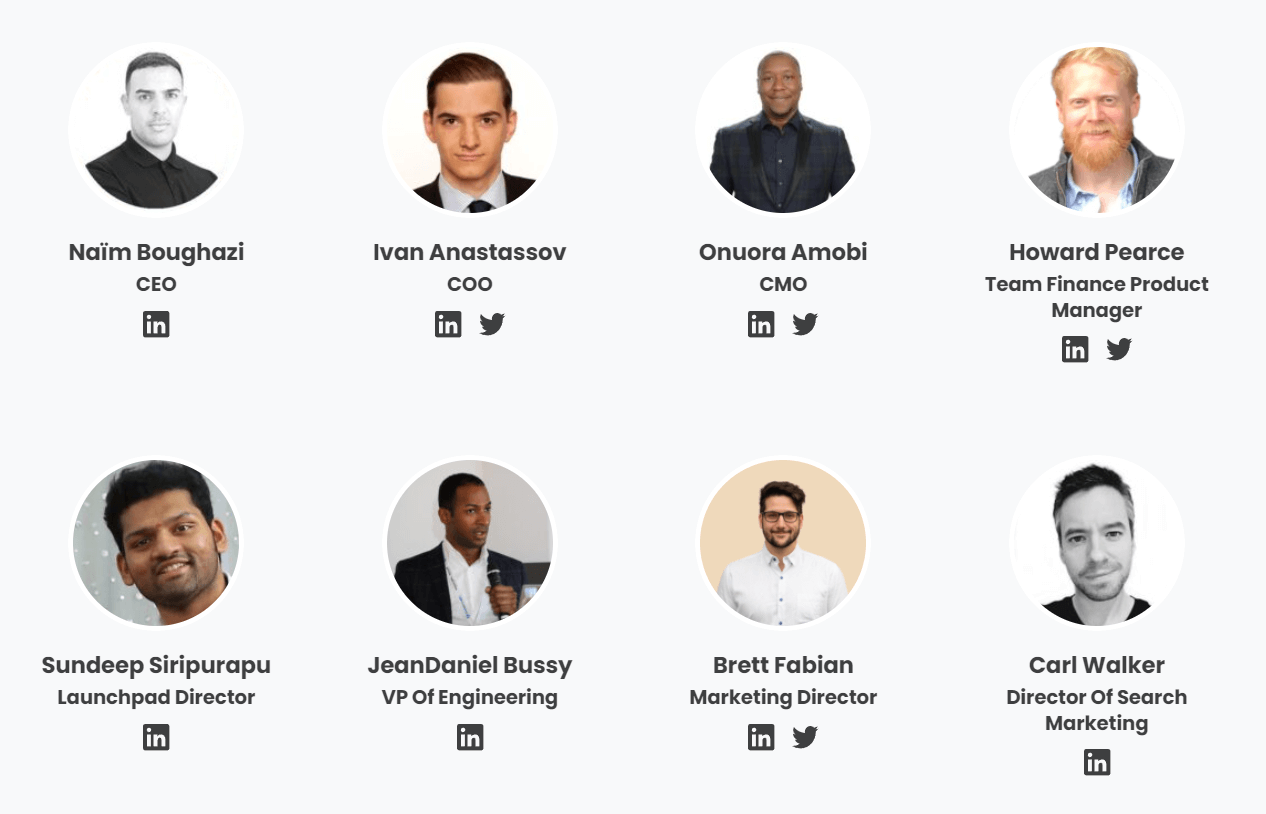

11. Reputation of Founders and Team

Behind every good liquidity locker is a team of experts.

Developers with cutting-edge programming languages and skills like Rust, Solidity, smart-contract development, Python, and Typescript.

Look for a team that actually employs UI/UX experts to help create the best possible wizards and dashboards.

What about project leaders, SEO experts, and marketing teams able to take the new services and features to market?

Research the backgrounds of the founders and core team members.

A team with deep experience in blockchain, cybersecurity, and DeFi is a good sign that the locker is reliable and well-managed.

Does the team proudly display their LinkedIn profiles, talk about the product, and have an open and transparent About page?

12. Community and Ecosystem Support

A strong, engaged community can significantly enhance the value and security of a liquidity locker.

Platforms that foster a supportive ecosystem through developer communities, partnerships, and integrations with other DeFi tool are often more resilient and innovative.

Consider how active and engaged its community is, and whether the platform supports or integrates with other essential DeFi services.

Key Points:

- Active Developer Community:

- How active and engaged is the developer community around the platform?

- Does the platform encourage community contributions and feedback?

- Ecosystem Integration:

- What other DeFi tools and services does the platform integrate with?

- Are there strong partnerships that enhance the platform's value?

13. Tokenomics

You may have already worked out the tokenomics model for your token/coin.

But it's important to consider that the locker needs to align with this mission.

Not only should they support the blockchain you want to use now, but also ensure that it aligns with your distribution and vesting schedules.

Key Points:

- Tokenomics Tools or Wizards:

- Look for providers that include built-in tools or wizards to help you design and manage your tokenomics.

- These tools can simplify complex calculations, ensuring that your liquidity strategy is in sync with your long-term goals.

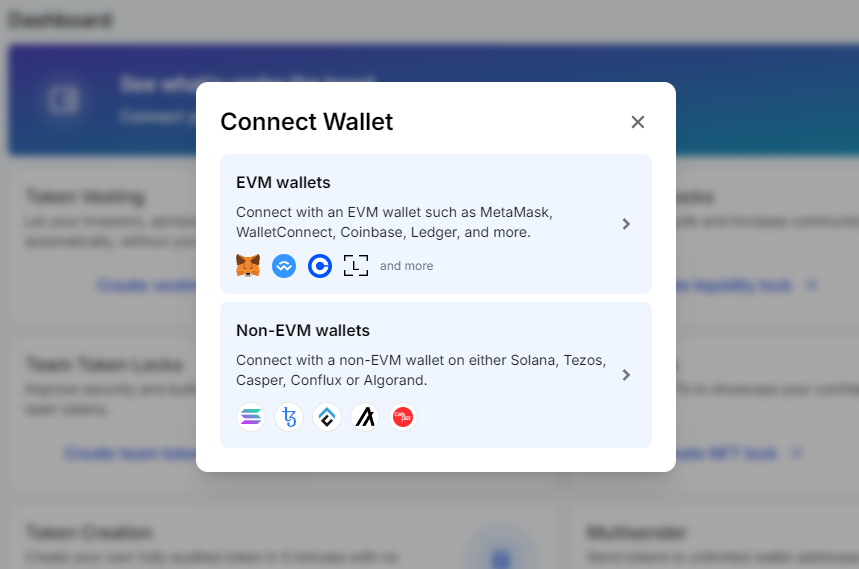

14. Wallet Compatibility

Making sure your wallet works with the provider is important for easy use and access on both desktop and mobile. Wallet compatibility lets you and your team connect securely from anywhere in the world.

Key Points:

- Wide Wallet Support:

- Choose a liquidity locker that supports a broad range of wallets, including popular options like MetaMask, Coinbase Wallet, OKX, and WalletConnect.

- Compatibility with Web3Modal can further enhance user experience by offering seamless integration with various dApps and blockchain networks.

- Ease of Access:

- Ensure that the locker allows users to connect their preferred wallets quickly and securely.

- Look for lockers that provide a simple, intuitive interface for wallet connections, reducing barriers for users to interact with your token.

- Cross-Platform Functionality:

- The liquidity locker should support both desktop and mobile wallet applications, allowing users to manage their assets on the go.

- Integration with Web3Modal can offer additional flexibility, enabling users to choose from a range of wallets when connecting to decentralized applications.

15. Continued Marketing Campaigns

I might be a little biased with this one, since I'm the one writing the post, but if any token services provider has gone quiet, that might tell a deeper story.

Along with transparency into who is working at the company - you should be looking at who is writing, and how often they're writing about what they do.

A clear sign of how much they love their own community is how closely they're connected to it through creating content, new landing pages, and updating their services.