How to Check Liquidity Locks

How do you check for Locked Liquidity, what services and tools can you use?

With so many new projects popping up, the risk of getting scammed is real, especially with the notorious rug pulls.

Rug pulls happen when project developers (or anyone in the project) suddenly withdraws liquidity, leaving investors with worthless tokens.

That’s where liquidity locks come in. They're like safety nets for liquidity, and knowing how to check them is crucial.

What is a Liquidity Locker?

They're kind of like putting a padlock on the cookie jar.

It makes sure the project developers can’t just grab all the cookies (liquidity) and run off. Depending on the project, they can be time-based (like a set number of months) or event-based (like after a milestone is hit).

Without this lock, the project’s tokens could drop in value fast - leaving you and the token in a bad position.

- Time-Based: Liquidity is secured for a specific duration, such as 6 months or a year. During this period, the developers cannot access the liquidity.

- Event-Based: The liquidity remains locked until a particular event occurs, such as the completion of a project milestone.

LP Locks are also important in keeping the market table. By preventing sudden withdrawals, they help ensure that the token's value remains stable.

Why Verify Liquidity Locks?

Trusting a project without checking its liquidity lock is like leaving your wallet open and hoping no one dips their hand in.

Unverified liquidity poses significant risks, the most prominent being rug pulls. It's important to do your research and check liquidity locks - literally verifying their existence and if they're real.

How Can You Check Liquidity is Locked?

1. Blockchain Explorers:

First up, you’ve got blockchain explorers like Etherscan or BscScan. Just enter the contract address and you can view detailed transaction data, including whether the liquidity is tied up in a smart contract.

These platforms allow you to see the amount locked, the duration, and other relevant details. However, they're often hard to use, difficult to find the information you're looking for, and not every chain has an explorer with all the details!

2. Dedicated Liquidity Lock Platforms:

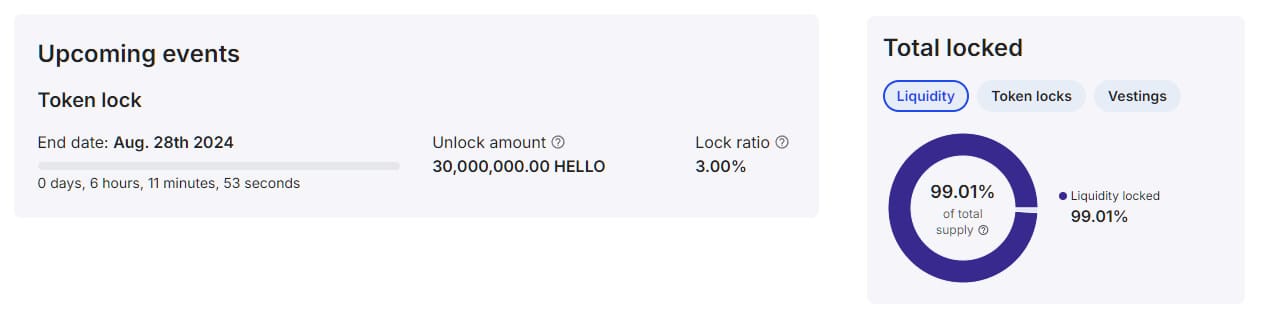

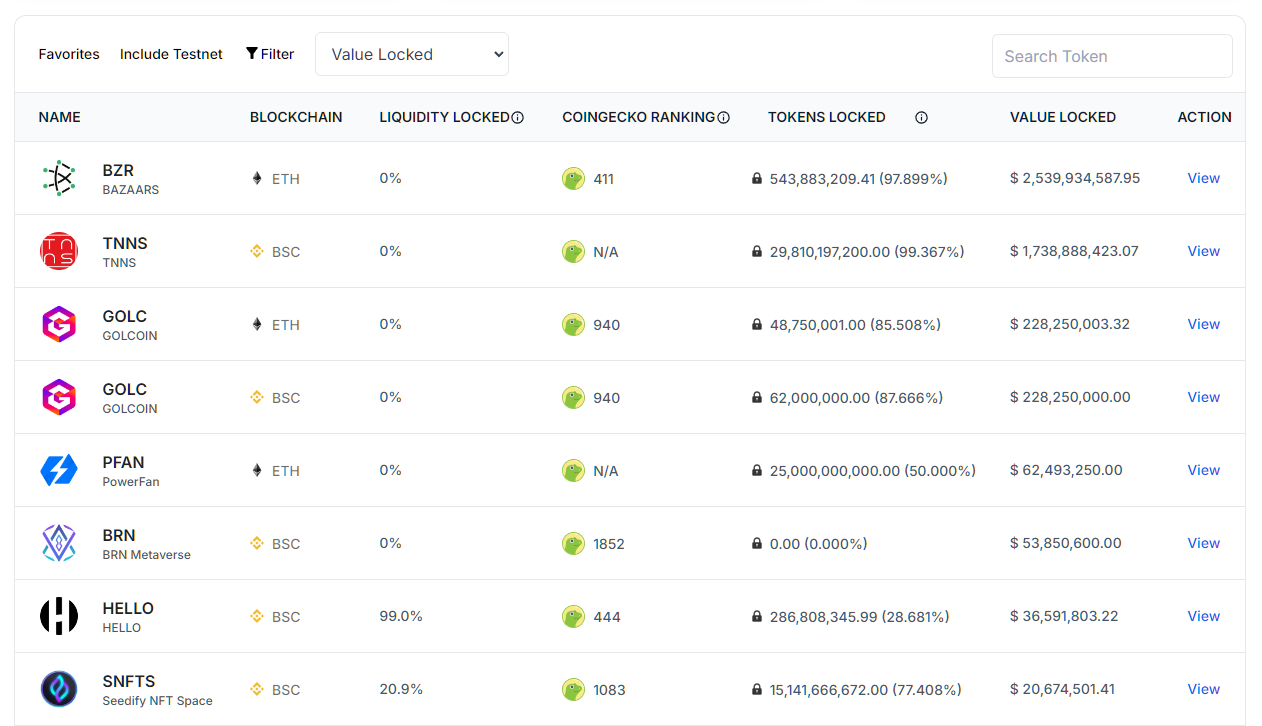

Some of the leaders in the space offer apps and dashboards for locking liquidity and providing verification services. These platforms have public pages where you can see the status of liquidity locks for various projects easily.

They’ll show you everything you need to know about the liquidity lock, and it’s all out there for you to see, no secrets.

3. Manual Checking:

For those with technical expertise, you can manually look through the smart contract code. This involves inspecting the contract’s functions, if you know what you’re looking at, you can spot if something’s off. Check the code for details on how long the liquidity is locked and where exactly it’s locked up.

4. Community and Project Communication:

Engaging with the project's community on platforms like Reddit, Telegram, and Discord can give a little more information. Sometimes, the best insights come from chatting with other people.

Join the project’s community and look for lock information. The details may be old, hidden away in archives, or difficult to find timely responses - so we recommend using an app like the one found in Team.finance.

5. Third-Party Audits:

Auditors like CertiK, Bailsec and Hacken often include liquidity lock verification as part of their smart contract audits. This is definitely an additional layer of security - a good lock service will have their code audited.

6. Use of Liquidity Locking Services and Platforms:

Token management platforms offer user-friendly and easy tools to find all the details about a projects liquidity. There's not much to say here, you could probably guess a good provider (hint: take a look at the top of the page).

7. Tokenomics Analysis:

Another tip: check out the project’s whitepaper. It might describe the liquidity locking plan in plain sight. This is especially useful if the project is still in its early stages. Roadmaps are useful here too!

8. Check on DEX:

Some decentralized exchanges have tools to help you verify liquidity locks. If you’re already on a Dex like QuickSwap, take a look around the projects page. We also recommend DexTools, they have a great way to immediately identify, and visit the locking provider's website, to verify the token details.

9. Smart Contract Event Logs:

For the advanced folks out there, you can look at smart contract event logs. This requires a deeper understanding of blockchain technology but offers a transparent and verifiable record of all contract activities.

10. Transparency and Communication:

Finally, keep your eyes on the project’s official channels. Many projects regularly update their community on the status of liquidity locks through their website, social media channels, or platforms like Medium. It's important to do your own research, be extensive in your search, and if in doubt: contact the project directly!

Advantages of Using Liquidity Lock Checkers

Using these tools isn’t just about being cautious - it’s about being smart. They help you see what’s really going on behind the scenes, reducing the chances of fraud and making sure your investments are safe.

Plus, when a project is upfront about its liquidity lock, it’s a good sign that they’re in it for the long haul, which is what you want in a project.

Who do we recommend to check for liquidity on a token?

Team.finance has been keep track of locks for years - with over 35,000 projects trusting and using our services. We've seen excellent use cases from thousands of successful web3 projects - all using our token management solutions.

Of course, we commend using our locking services - not just for new projects, but with our View All Coins page you can check the liquidity lock of any potential project for your portfolio.